"Sales Tax Software Market Size And Forecast by 2031

Central to the analysis is the identification and evaluation of the Top 10 Companies in the Sales Tax Software Market. These organizations are recognized for their substantial market share and pivotal roles in driving industry growth. The report provides a detailed assessment of their business strategies, ranging from product development to market expansion efforts. It also highlights how these companies leverage technological advancements and market trends to maintain their leadership positions.

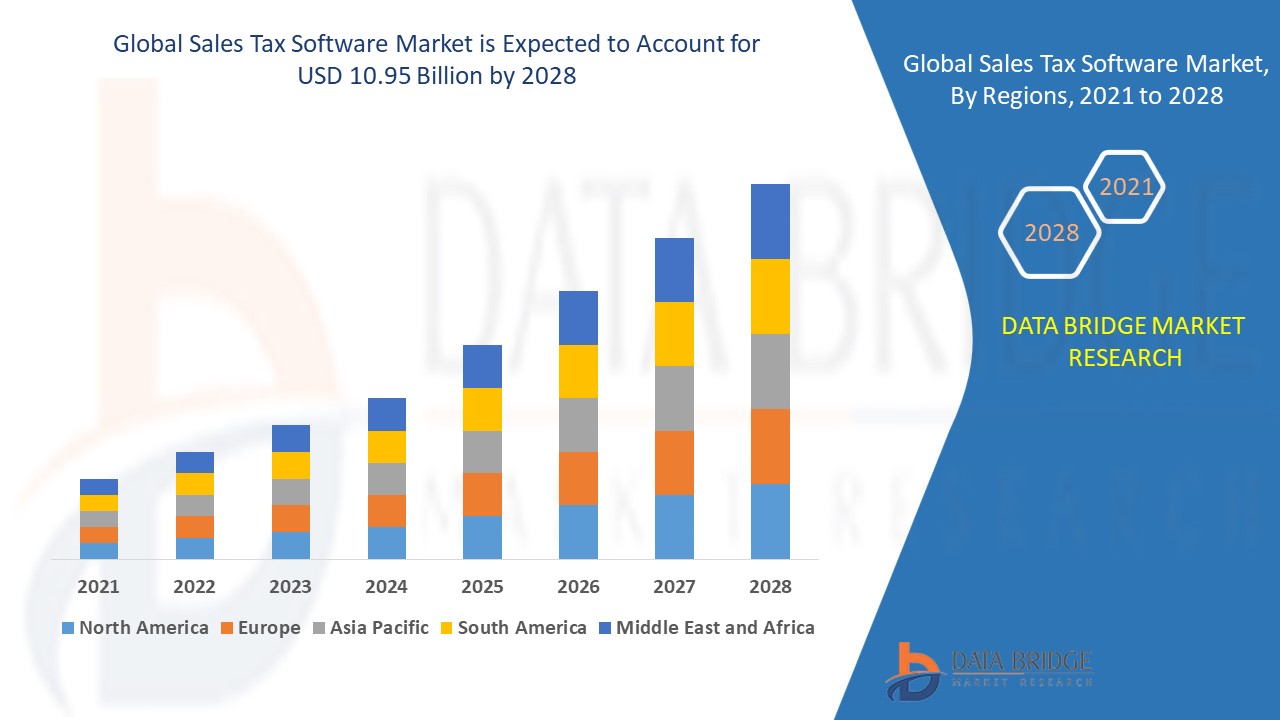

The sales tax software market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05% in the forecast period of 2021 to 2028.

The Sales Tax Software Marketis a dynamic and rapidly evolving industry, encompassing a wide range of applications and opportunities. With significant advancements in technology, shifting consumer preferences, and increasing demand for innovative solutions, the market has grown to become a vital sector in the global economy. This report provides a comprehensive analysis of the Sales Tax Software Market, covering its size, share, scope, and the key factors influencing its development.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sales-tax-software-market

Which are the top companies operating in the Sales Tax Software Market?

The Top 10 Companies in Sales Tax Software Market include well-established players. These companies are known for their market expertise, strong product portfolios, and significant market share. Their innovation, customer focus, and global operations have helped them maintain leadership positions in the market, offering high-quality solutions and services that meet the evolving needs of consumers.

**Segments**

- On-Premises

- Cloud-Based

- Hybrid

The global sales tax software market is segmented based on deployment mode into on-premises, cloud-based, and hybrid solutions. On-premises software installations are traditional systems that are deployed and operated from a company's in-house server and computing infrastructure. Cloud-based solutions, on the other hand, are gaining popularity due to their flexibility and cost-effectiveness, as they are hosted on third-party servers and accessed over the internet. Hybrid solutions combine the features of both on-premises and cloud-based software, offering a more customizable and scalable option for businesses with specific needs.

**Market Players**

- Avalara, Inc.

- Vertex, Inc.

- ADP, LLC

- Sovos Compliance, LLC

- CCH Incorporated

- Wolters Kluwer

- Thomson Reuters

- Intuit Inc.

- Xero Limited

- TaxJar

- TaxCloud

- Exactor

- Drake Software

- AccurateTax.com

- Canopy Tax

Key market players in the sales tax software industry include Avalara, Inc., a leading provider of cloud-based tax compliance solutions; Vertex, Inc., a global provider of tax technology solutions; ADP, LLC, a well-known provider of human capital management services with integrated tax solutions; and Sovos Compliance, LLC, a provider of tax compliance and reporting solutions. Other prominent players in the market include CCH Incorporated, Wolters Kluwer, Thomson Reuters, Intuit Inc., Xero Limited, TaxJar, TaxCloud, Exactor, Drake Software, AccurateTax.com, and Canopy Tax. These companies contribute to the competitive landscape of the sales tax software market by offering a wide range of solutions to meet the diverse needs of businesses worldwide.

https://www.databridgemarketresearch.com/reports/global-sales-tax-software-marketThe sales tax software market is experiencing significant growth due to the increasing focus on tax compliance and the need for efficient solutions to manage complex tax requirements across different regions. As businesses expand globally, the demand for sales tax software that can automate calculations, filings, and reporting processes is on the rise. Companies are looking for solutions that can help them stay compliant with changing tax laws and regulations while optimizing their tax operations for improved efficiency and cost savings.

One of the key trends driving the sales tax software market is the shift towards cloud-based solutions. Cloud-based software offers businesses the flexibility to access tax compliance tools from anywhere, at any time, without the need for large upfront investments in infrastructure. This has made cloud-based solutions particularly attractive to small and medium-sized enterprises looking for cost-effective and scalable tax compliance solutions. Additionally, cloud-based software providers are constantly innovating to offer advanced features such as real-time tax calculations, automated updates for tax rate changes, and integration with other business systems.

Another trend shaping the sales tax software market is the increasing focus on compliance automation and risk management. With the growing complexity of tax regulations and the potential for costly penalties for non-compliance, businesses are seeking software solutions that can streamline their tax processes, reduce manual errors, and provide accurate and timely reporting. Advanced sales tax software offerings now include features such as automated tax calculation, tax document management, audit trail capabilities, and integration with accounting systems for seamless data flow.

Furthermore, the market landscape for sales tax software is highly competitive, with a diverse range of players offering specialized solutions to cater to various industry verticals and business sizes. Established vendors such as Avalara, Vertex, and Thomson Reuters have strong market presence and offer comprehensive tax compliance suites with advanced features and global capabilities. At the same time, niche players like TaxJar and TaxCloud focus on specific aspects of sales tax compliance, such as e-commerce sales tax automation or cloud-based tax calculations, to address the unique needs of their target customers.

In conclusion, the global sales tax**Market Players**

The major players covered in the sales tax software market report are APEX Analytix, LLC; Avalara Inc.; CCH.; Intuit Inc.; LumaTax, Inc.; Ryan, LLC; Sage Intacct, Inc.; Sales Tax DataLINK; Sovos Compliance, LLC; Thomson Reuters; Vertex, Inc.; Zoho Corporation Pvt. Ltd.; Xero Limited; The Federal Tax Authority, LLC d/b/a TaxCloud; Wolters Kluwer; CFS Tax Software Inc.; Service Objects, Inc.; TaxJar; Chetu Inc. and HRB Digital LLC among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

The sales tax software market is witnessing robust growth driven by the increasing emphasis on tax compliance and the necessity for streamlined solutions to manage intricate tax requirements globally. The expansion of businesses across various regions has propelled the demand for sales tax software capable of automating calculations, filings, and reporting processes. Companies are seeking solutions that ensure compliance with evolving tax laws while enhancing the efficiency and cost-effectiveness of their tax operations.

A significant trend influencing the sales tax software market is the transition towards cloud-based solutions. Cloud technology offers businesses the flexibility to access tax compliance tools remotely without substantial upfront investments in infrastructure. This has particularly appealed to small and medium

Explore Further Details about This Research Sales Tax Software Market Report https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market

Key Insights from the Global Sales Tax Software Market :

- Comprehensive Market Overview: The Sales Tax Software Market is experiencing robust growth, fueled by increasing adoption of innovative technologies and evolving consumer demands.

- Industry Trends and Projections: The market is expected to grow at a CAGR of X% over the next five years, with digital transformation and sustainability driving key trends.

- Emerging Opportunities: Rising consumer demand for eco-friendly and customizable products is creating significant market opportunities.

- Focus on R&D: Companies are intensifying their focus on R&D to develop advanced solutions and stay ahead of emerging market trends.

- Leading Player Profiles: Key players are at the forefront, with strong market shares and continuous innovation.

- Market Composition: The market consists of a mix of large established players and smaller, agile companies, each contributing to dynamic competition.

- Revenue Growth: The market is experiencing steady revenue growth, driven by increased consumer spending and expanding product offerings.

- Commercial Opportunities: There are ample commercial opportunities in untapped regions, particularly in emerging economies with growing demand.

Get More Reports:

North America SiC Power Semiconductor Market Revenue and Future Scope Insights: Growth, Share, Value, Size, and Trends

Asia-Pacific Digital Diabetes Management Market Graphical Trends: Growth, Share, Value, Size, and Analysis

North America Glioblastoma Multiforme Treatment Market Challenges and Insights: Growth, Share, Value, Size, and Scope

Europe Digital Experience Platform Market Revenue and Future Scope Trends: Growth, Share, Value, Size, and Analysis

Asia-Pacific Retort Packaging Market Growth Drivers: Trends, Statistics, Value, Size, and Scope

North America ChloroHydroxyPropylTrimethyAmmonium Chloride (CHPTAC) Market Scope and Opportunities Insights: Growth, Share, Value, Size, and Trends

Asia-Pacific Cochlear Implants Market Size and Analysis: Growth, Share, Value, Scope, and Trends

Asia-Pacific ChloroHydroxyPropylTrimethyAmmonium chloride (CHPTAC) Market Revenue and Future Scope Insights: Growth, Share, Value, Size, and Trends

Asia-Pacific Polystyrene Packaging Market Revenue Forecast and Growth: Share, Value, Size, and Trends

Europe Circulating Tumor Cells (CTC) Liquid Biopsy Market CAGR and Revenue Forecast: Growth, Share, Value, Size, and Scope

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]"